Miami's multifamily rental market, which saw a significant boom in recent years, is now experiencing a noticeable slowdown. This change is attributed to several key factors impacting both developers and renters.

Impact of Higher Borrowing Costs

One of the main reasons for this slowdown is the rise in borrowing costs. The Federal Reserve has increased interest rates, making it more expensive for developers to finance new apartment projects. This has resulted in fewer construction starts as developers struggle to secure affordable loans.

Rising Costs of Construction

In addition to higher borrowing costs, the price of construction materials and labor has surged. These rising costs have made it more difficult for developers to start new projects. Some developers argue that the increased cost of materials, such as cement, has a more significant impact than the interest rates themselves. This combination of factors has led to a reduction in new multifamily construction starts.

Increased Supply and Higher Vacancy Rates

Miami has seen a substantial influx of newly built apartments, which has led to higher vacancy rates and slowed rent growth. In the first three quarters of last year, over 13,000 units were completed in South Florida, surpassing the total for the previous year and increasing the vacancy rate. This influx of new units has saturated the market, making it difficult for landlords to maintain high occupancy levels and competitive rental rates

Specific Multifamily Developers Impacted

Several developers have been significantly affected by these changes. Michael Neal, CEO of Kast Construction, has noted the impact of the restrictive lending environment on their projects. Kast Construction, a major player in Florida, has seen a decrease in their volume of multifamily projects due to the difficulty in obtaining construction loans.

Jeffrey Burns, CEO of Affiliated Development, highlights similar challenges, particularly for affordable housing projects. Affiliated Development, which blends market-rate and affordable units, has faced hurdles with rising costs and limited financing options, affecting their ability to start new projects.

Rafael Aregger of Empira Group, a Swiss developer, is also experiencing the slowdown. Empira Group plans to deliver several new apartment buildings in Miami by 2026, but they acknowledge that the current market conditions have resulted in slower lease-up speeds and lower rent growth expectations.

Market Saturation and Lender Caution

Despite a continued strong demand for rental housing driven by migration to Miami, there is a sense of market saturation. Lenders have become more cautious, slowing down the pace of new construction starts. The geographic constraints of Miami also limit available land for new developments, further contributing to the slowdown.

Affordability Challenges

Affordability remains a critical issue in Miami. The median asking rent has increased significantly in recent years, outpacing wage growth. This disparity makes it difficult for many residents to afford housing, which in turn affects the rental market dynamics. According to Ken Johnson, an economist at Florida Atlantic University, while rent increases have moderated, they are still high relative to income levels, leading to prolonged affordability issues.

Other Cities Experiencing Slowdowns in Multifamily Rental Buildings

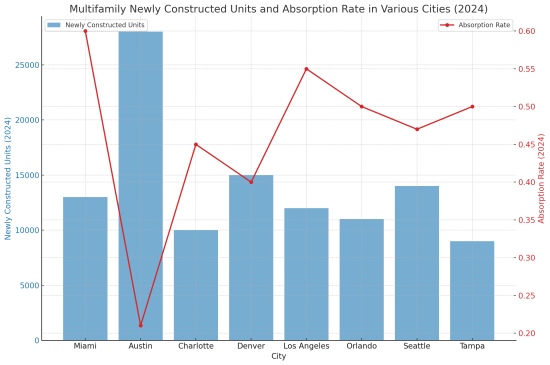

The multifamily rental market slowdown isn't unique to Miami; several other cities in Florida and across the United States are experiencing similar trends. Below is a graph representing the multifamily newly constructed units and absorption rates for various cities in 2024 accoding to the 2024 Matthews Multifamily Market Report Review and Outlook, CBRE 2024 U.S. Real Estate Market Outlook and 23Q4 Multifamil - South Florida Market Report.

Miami:

Miami: With 13,000 newly constructed units and an absorption rate of 60%, Miami's market shows signs of oversaturation, leading to higher vacancy rates.

Austin: The city is facing an oversupply with 28,000 new units and a low absorption rate of 21%.

Charlotte: Similar issues with oversupply and an absorption rate of 45% for 10,000 new units.

Denver: 15,000 new units with a 40% absorption rate, reflecting high vacancy rates.

Los Angeles: Despite 12,000 new units and a 55% absorption rate, high construction and borrowing costs are slowing down new developments.

Orlando and Tampa: Both cities face similar challenges with 11,000 and 9,000 new units and absorption rates of 50%.

Seattle: Experiencing high levels of new construction (14,000 units) but only a 47% absorption rate.

In summary, Floridian cities, Miami, Orlando, and Tampa, along with others nationwide, are experiencing a slowdown in the multifamily rental market due to higher borrowing and construction costs, increased supply, market saturation, lender caution, and affordability challenges. These factors are reshaping the landscape for both developers and renters, marking a significant shift from the rapid growth seen in recent years.